Affiliate marketing in the credit card niche offers an exciting way to earn commissions while promoting financial services. With high commissions, recurring earnings, and strong consumer demand, credit card affiliate marketing programs provide a lucrative opportunity for affiliates looking to maximize their earnings in the finance sector.

These programs cater to finance bloggers, travelers, and business owners, offering recurring revenue and flexible payouts. By partnering with trusted financial institutions and leveraging high-paying credit card CPA offers, affiliates can generate consistent income while helping consumers find the best financial products for their needs.

Fresh marketing content and materials, trendy topics and good vibes.

Subscribe to the Olavivo blog and chill with us.

What Are Credit Card Affiliate Marketing Programs?

Credit card affiliate programs allow marketers to earn commissions by referring users to apply for specific credit cards. Affiliates partner with banks, financial institutions, or affiliate networks to promote credit cards through websites, blogs, or social media platforms.

Types of Credit Card Affiliate Marketing Programs

Credit card affiliate marketing programs come in various forms, each catering to different business models and payout structures. Understanding the different types available can help you choose the right one for your audience and maximize your commissions. Below are some of the most common types of credit card affiliate programs.

- CPA (Cost Per Acquisition) – Earn a commission when a user gets approved for a credit card.

- Revenue Share – Get a percentage of the cardholder’s transactions.

- Hybrid Model – Combines CPA and revenue share commissions.

- Credit Card Referral Programs – Earn bonuses for every successful referral.

Why Choose Credit Card Affiliate Marketing?

Affiliate marketing in the credit card niche offers a lucrative opportunity for marketers looking to earn high commissions. With financial services in constant demand, this niche provides a stable revenue stream. Here are some compelling reasons why you should consider joining a credit card affiliate marketing program.

- High Commissions: Many programs offer high payouts per approval.

- Consistent Demand: Credit cards are essential financial tools.

- Recurring Earnings: Some programs provide lifetime commissions.

- Diverse Niches: Travel, business, and personal finance categories.

- Trusted Brands: Work with Visa, Mastercard, American Express, and more.

How to Choose the Best Credit Card Affiliate Marketing Programs?

Not all credit card affiliate programs are created equal. The right program can significantly impact your earning potential. Before signing up, it’s crucial to evaluate key factors such as commission rates, brand reputation, and available marketing support. Here’s how to identify the best program for your needs.

- Commission Structure – Look for high-paying or recurring commission programs.

- Reputation of the Provider – Partner with reputable banks and networks.

- Target Audience – Choose a program that aligns with your audience (travelers, business owners, students).

- Marketing Support – Opt for programs that provide banners, landing pages, and tracking tools.

Top 25 Best Credit Card Affiliate Marketing Programs in 2025

If you’re looking to earn commissions through credit card affiliate marketing programs, this list covers the best options available. Whether you want high-paying credit card CPA offers, recurring revenue programs, or top credit card referral programs, these affiliate opportunities can help you monetize your audience effectively.

| Program Name | Commission Rate | Cookie Duration |

| American Express Affiliate Program | Up to $200 per approved application | 7 days |

| Chase Affiliate Program | Varies by product; higher for credit cards | 7 days |

| Capital One Affiliate Program | Up to 8% per extension install; up to $500 yearly | 30 days |

| Creditcards.com Affiliate Program | Not specified | Not specified |

| M1 Affiliate Program | Up to $70 per qualified funding | 30 days |

| TransUnion Affiliate Program | $48 per sale | 30 days |

| Credit Karma Affiliate Program | $2 per new signup | 30 days |

| Bankrate Credit Cards | Not specified | Not specified |

| Credit Assistance Network | $1.25 per lead, $110 per sale | 365 days |

| USAA Credit Cards Affiliate Program | $25 per lead | 30 days |

| Credit.com Affiliate Program | Not specified | Not specified |

| Luxury Card Affiliate Program | $405 per sale | 30 days |

| Scotiabank Credit Cards Affiliate Program | Up to CA$99 per approved credit card account | 30 days |

| Capital Bank (OpenSky Credit Cards) Affiliate Program | Up to $25 per lead | 30 days |

| Upgrade Credit Card Affiliate Program | $60 per referral | 30 days |

| Avianca LifeMiles Credit Card Affiliate Program | $200 per lead | 30 days |

| Indigo Platinum MasterCard Affiliate Program | $35 per lead | Not specified |

| Experian Affiliate Program | $8 per sale (potential $30 CPA via affiliate networks) | Not specified |

| Square Affiliate Program | $5 per sign-up, up to $233 depending on product | 45 days |

| Chime Affiliate Program | 10% of Monthly Recurring Revenue (MRR) for 18 months | 30 days |

| Credit Sesame Affiliate Program | $3.00-$6.00 per signup | 30 days |

| Commission Soup Affiliate Program | Varies | Varies |

| BankAffiliates.com Affiliate Program | Dependent on program | Dependent on program |

| Visa Affiliate Program | $25-$100 per approved application | 30 days |

| Discover Affiliate Program | $50-$100 per approved application | 30 days |

What are the 25 Best Credit Card Affiliate Marketing Programs in 2025?

Affiliate marketing in the credit card niche offers high commissions and recurring revenue. Below are some of the best credit card affiliate marketing programs available, each providing unique benefits and earning opportunities.

1. American Express Affiliate Program

American Express is a globally recognized financial institution known for its premium credit cards and exceptional customer service. The affiliate program offers generous commissions for referring new cardholders, making it an attractive option for finance-focused affiliates looking to promote trusted financial products.

Key Highlights:

- URL: American Express Affiliate Program

- Commission: Up to $200 per approved application

- Cookie Duration: 7 days

- High Conversions: Strong brand trust increases approvals

2. Chase Affiliate Program

Chase is one of the largest banks in the U.S., offering a diverse range of financial products, including credit cards, mortgages, and investment services. Affiliates can earn commissions by promoting Chase’s highly competitive credit card offerings, making it a profitable option for those in the finance and banking niche.

Key Highlights:

- URL: Chase Affiliate Program

- Commission: Varies by product; higher for credit cards

- Cookie Duration: 7 days

- High Conversions: Trusted banking brand

3. Capital One Affiliate Program

Capital One is a leading credit card issuer known for its flexible rewards programs and financial products. The affiliate program offers substantial earning potential with competitive commissions, making it an excellent choice for affiliates targeting consumers looking for cashback and travel rewards credit cards.

Key Highlights:

- URL: Capital One Affiliate Program

- Commission: Up to 8% per extension install; up to $500 yearly

- Cookie Duration: 30 days

- Recurring Revenue: Potential long-term earnings

4. Creditcards.com Affiliate Program

Creditcards.com is a well-established credit card comparison site that helps consumers make informed financial decisions. By partnering with top banks and financial institutions, affiliates can earn commissions by directing users to various credit card offers available on the platform.

Key Highlights:

- URL: Creditcards.com Affiliate Program

- Commission: Not specified

- Cookie Duration: Not specified

- Promotional Resources: Tools for credit card comparisons

5. M1 Affiliate Program

M1 Finance is an innovative financial platform that integrates automated investing, borrowing, and banking services. Affiliates can earn commissions by referring users to M1’s unique investment-based credit and debit solutions, making it a great choice for fintech and finance bloggers.

Key Highlights:

- URL: M1 Affiliate Program

- Commission: Up to $70 per qualified funding

- Cookie Duration: 30 days

- Flexible Payout Options: Various earning models

6. TransUnion Affiliate Program

TransUnion is a global credit reporting agency offering credit score monitoring and financial insights. Affiliates can earn commissions by promoting TransUnion’s services, helping users manage and improve their credit scores through comprehensive reports and alerts.

Key Highlights:

- URL: TransUnion Affiliate Program

- Commission: $48 per sale

- Cookie Duration: 30 days

- Recurring Revenue: Credit monitoring subscription model

7. Credit Karma Affiliate Program

Credit Karma provides free credit scores, credit monitoring, and personalized financial recommendations. The affiliate program offers a simple way to earn commissions by referring users who want to take control of their credit health with Credit Karma’s free services.

Key Highlights:

- URL: Credit Karma Affiliate Program

- Commission: $2 per new signup

- Cookie Duration: 30 days

- High Conversions: Free financial services attract users

8. Bankrate Credit Cards

Bankrate is a leading financial services website that provides users with expert credit card comparisons and insights. Affiliates can earn commissions by directing traffic to Bankrate’s extensive selection of credit card reviews and financial tools.

Key Highlights:

- URL: Bankrate Credit Cards

- Commission: Not specified

- Cookie Duration: Not specified

- Promotional Resources: Detailed credit card comparisons

9. Credit Assistance Network

Credit Assistance Network specializes in helping consumers repair and improve their credit scores. Affiliates can earn commissions by promoting these services, making it an excellent choice for those targeting an audience seeking financial recovery solutions.

Key Highlights:

- URL: Credit Assistance Network

- Commission: $1.25 per lead, $110 per sale

- Cookie Duration: 365 days

- Recurring Revenue: Long-term credit improvement services

10. USAA Credit Cards Affiliate Program

USAA offers financial services exclusively for military members and their families. Their credit card affiliate program provides solid commissions, making it an attractive option for affiliates targeting military personnel and veterans looking for financial solutions.

Key Highlights:

- URL: USAA Credit Cards Affiliate Program

- Commission: $25 per lead

- Cookie Duration: 30 days

- High Conversions: Strong brand loyalty among military families

11. Credit.com Affiliate Program

Credit.com is a trusted online platform offering users access to their credit scores and financial tools to manage credit effectively. Their referral program provides affiliates with a way to earn commissions by promoting financial education and credit monitoring services.

Key Highlights:

- Commission: Not specified

- Cookie Duration: Not specified

- Promotional Resources: Credit tools and reports

12. Luxury Card Affiliate Program

Luxury Card is a premium credit card offer that provides exclusive rewards, travel perks, and high-end benefits. Affiliates can earn substantial commissions by referring high-net-worth individuals who are interested in luxury financial services.

Key Highlights:

- URL: Luxury Card Affiliate Program

- Commission: $405 per sale

- Cookie Duration: 30 days

- High Conversions: Luxury-focused audience

13. Scotiabank Credit Cards Affiliate Program

Scotiabank is one of Canada’s leading financial institutions, offering a wide range of credit cards with rewards, cashback, and travel benefits. Affiliates can earn commissions by referring customers who apply and get approved for a Scotiabank credit card.

Key Highlights:

- URL: Scotiabank Affiliate Program

- Commission: Up to CA$99 per approved credit card account

- Cookie Duration: 30 days

- Flexible Payout Options: Competitive affiliate structure

14. Capital Bank (OpenSky Credit Cards) Affiliate Program

OpenSky Credit Cards, offered by Capital Bank, are designed for individuals with limited or no credit history. This program allows affiliates to earn commissions while helping consumers build their credit responsibly.

Key Highlights:

- Commission: Up to $25 per lead

- Cookie Duration: 30 days

- High Conversions: Targeting credit-building customers

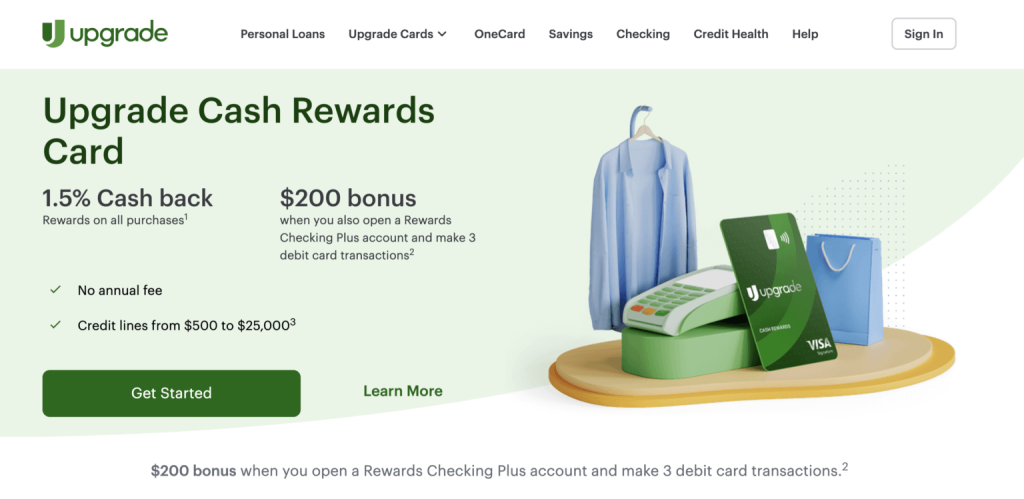

15. Upgrade Credit Card Affiliate Program

Upgrade Credit Card provides users with flexible financial solutions, including installment payments and rewards. Affiliates can benefit from this program by promoting Upgrade’s easy application process and financial management tools.

Key Highlights:

- URL: Upgrade Affiliate Program

- Commission: $60 per referral

- Cookie Duration: 30 days

- Promotional Resources: Credit improvement tools

16. Avianca LifeMiles Credit Card Affiliate Program

Avianca LifeMiles Credit Card allows customers to earn airline miles with every purchase, making it ideal for frequent travelers. Affiliates can capitalize on the travel rewards niche with this high-commission program.

Key Highlights:

- URL: Avianca Lifetimes Affiliate Program

- Commission: $200 per lead

- Cookie Duration: 30 days

- High Conversions: Popular among frequent travelers

17. Indigo Platinum MasterCard Affiliate Program

The Indigo Platinum MasterCard is designed for individuals with less-than-perfect credit who need a card to rebuild their financial standing. Affiliates can promote this card to credit-challenged consumers looking for second-chance opportunities.

Key Highlights:

- Commission: $35 per lead

- Cookie Duration: Not specified

- Recurring Revenue: Helps users establish credit

18. Experian Affiliate Program

Experian is a global leader in credit monitoring and identity protection services. Affiliates can earn commissions by promoting credit reports, score monitoring, and fraud prevention tools to individuals looking to manage their financial health.

Key Highlights:

- URL: Experian Affiliate Program

- Commission: $8 per sale (potential $30 CPA via affiliate networks)

- Cookie Duration: Not specified

- Promotional Resources: Credit score & identity protection

19. Square Affiliate Program

Square provides payment solutions for small businesses, including POS systems, invoicing, and payroll services. Affiliates can earn commissions by referring business owners who need seamless financial tools.

Key Highlights:

- URL: Square Affiliate Program

- Commission: $5 per sign-up, up to $233 depending on product

- Cookie Duration: 45 days

- Flexible Payout Options: High commission potential

20. Chime Affiliate Program

Chime offers a streamlined banking experience with no hidden fees, making it a popular choice for individuals looking for financial simplicity. Affiliates earn recurring commissions by referring new users to Chime’s checking, savings, and secured credit card services.

Key Highlights:

- URL: Chime Affiliate Program

- Commission: 10% of Monthly Recurring Revenue (MRR) for 18 months

- Cookie Duration: 30 days

- Recurring Revenue: Long-term earning potential

21. Credit Sesame Affiliate Program

Credit Sesame provides free credit scores, monitoring, and financial tools to help users manage loans, credit card payments, and mortgages. Affiliates can earn commissions by referring users to this free service, which is accessible to both homeowners and renters without requiring a credit card or trial period.

Key Highlights:

- URL: Credit Sesame Affiliate Program

- Commission: $3.00-$6.00 per signup

- Cookie Duration: 30 days

- Promotional Resources: Eye-catching creative assets

22. Commission Soup Affiliate Program

Commission Soup is a specialized CPA network focusing on financial services, particularly credit card offers. Acting as an intermediary, it connects affiliates with major credit card companies, offering niche-secured card promotions with lower competition and a broad audience in need of credit rebuilding.

Key Highlights:

- URL: Commission Soup Affiliate Program

- Commission: Varies

- Cookie Duration: Varies

- High Conversions: Targets credit-rebuilding consumers

23. BankAffiliates.com Affiliate Program

BankAffiliates.com is a dedicated financial affiliate network covering credit cards, personal loans, credit repair, and insurance. It boasts some of the highest payouts in the industry and runs regular contests and bonuses, making it an attractive option for finance-focused affiliates.

Key Highlights:

- Commission: Dependent on program

- Cookie Duration: Dependent on program

- Flexible Payout Options: Monthly contests and bonus programs

24. Visa Affiliate Program

Visa, one of the most recognized names in the financial world, offers a variety of credit cards, including cashback and travel rewards options. Global brand recognition enhances trust, increasing conversion rates for affiliates promoting Visa-branded credit cards.

Key Highlights:

- URL: Visa Affiliate Program

- Commission: $25-$100 per approved application

- Cookie Duration: 30 days

- Payment Methods: Direct deposit, check

25. Discover Affiliate Program

Discover’s affiliate program is ideal for affiliates targeting cashback enthusiasts. With popular rotating 5% cashback categories, it attracts a broad consumer base, making it one of the more competitive credit card affiliate programs available.

Key Highlights:

- URL: Discover Affiliate Program

- Commission: $50-$100 per approved application

- Cookie Duration: 30 days

- Payment Methods: Direct deposit

- Products: Discover it Cash Back, Student, Secured cards

What Are the Benefits of Joining Credit Card Affiliate Marketing Programs

Joining a credit card affiliate marketing program comes with numerous advantages, including high commissions and recurring earnings. These programs cater to a broad audience, making them a profitable choice for affiliates in the finance niche. Below are some key benefits of participating in credit card affiliate marketing.

- Passive Income Potential – Earn commissions from referrals with minimal effort.

- Diverse Offerings – Promote different types of credit cards (travel, business, cashback, student).

- Reliable Payouts – Many programs offer consistent and high payouts.

- Global Reach – Credit cards cater to a worldwide audience.

- Scalability – Easily scale campaigns to increase earnings.

How to Get Started with Credit Card Affiliate Marketing Programs

Starting with credit card affiliate marketing may seem complex, but following a structured approach can simplify the process. Choosing the right program, setting up your marketing strategy, and optimizing your campaigns are crucial steps. Here’s a step-by-step guide to help you launch your affiliate journey successfully.

- Step 1: Choose the Right Program – Select programs based on commission rates, reputation, and support.

- Step 2: Sign Up for the Program – Complete the application and get approved as an affiliate.

- Step 3: Promote the Program Effectively – Use SEO, social media, and paid ads to drive traffic.

- Step 4: Track and Optimize – Monitor performance and refine strategies for better conversions.

Tips for Successful Affiliate Marketing in the Credit Card Niche

Success in credit card affiliate marketing requires strategic planning and execution. From optimizing content to leveraging SEO and paid advertising, the right approach can boost your earnings. Below are some essential tips to help you thrive in this competitive niche.

- Focus on high-intent keywords and SEO strategies.

- Build trust by creating in-depth reviews and comparisons.

- Leverage social media and influencer marketing.

- Use email marketing to nurture leads.

- Optimize content with financial and banking trends.

Common Mistakes to Avoid in Credit Card Affiliate Marketing

While credit card affiliate marketing offers great earning potential, many affiliates make mistakes that hinder their success. Being aware of these pitfalls can help you refine your strategy and improve your results. Here are some common mistakes to watch out for and how to avoid them.

- Choosing low-paying programs with minimal benefits.

- Ignoring compliance guidelines and financial regulations.

- Over-promoting without providing real value.

- Using poor-quality traffic sources that result in low approvals.

- Not optimizing landing pages for conversions.

List of Best Affiliate Marketing Programs

- Mental Health Affiliate Programs

- Health and Wellness Affiliate Programs

- Recurring Affiliate Programs

- Meditation Affiliate Programs

- Health and Fitness Affiliate Programs

- Golf Affiliate Programs

- Tort Law Affiliate Programs

- Business Credit Card Affiliate Marketing Programs

- Real Estate Affiliate Marketing Programs

Conclusion

Credit card affiliate marketing programs offer a high-paying and scalable opportunity for affiliates. By choosing the right program, implementing effective promotional strategies, and avoiding common pitfalls, you can build a profitable business in this niche.

Ready to start earning with high-paying credit card affiliate programs? Join Olavivo today and take your affiliate marketing journey to the next level!

Frequently Asked Questions

Yes! The finance niche offers high commissions, strong demand, and recurring earnings, making it a profitable choice for affiliates.

Ensure your website has quality financial content, adheres to compliance guidelines, and aligns with the program´s target audience.

Some top networks include American Express, Chase and Capital One, which offer various credit card programs.

Yes, but having a website enhances credibility. You can also use social media, YouTube, and email marketing.

Earnings vary, but commissions range from $50 to $500 per approved applicant, depending on the program.